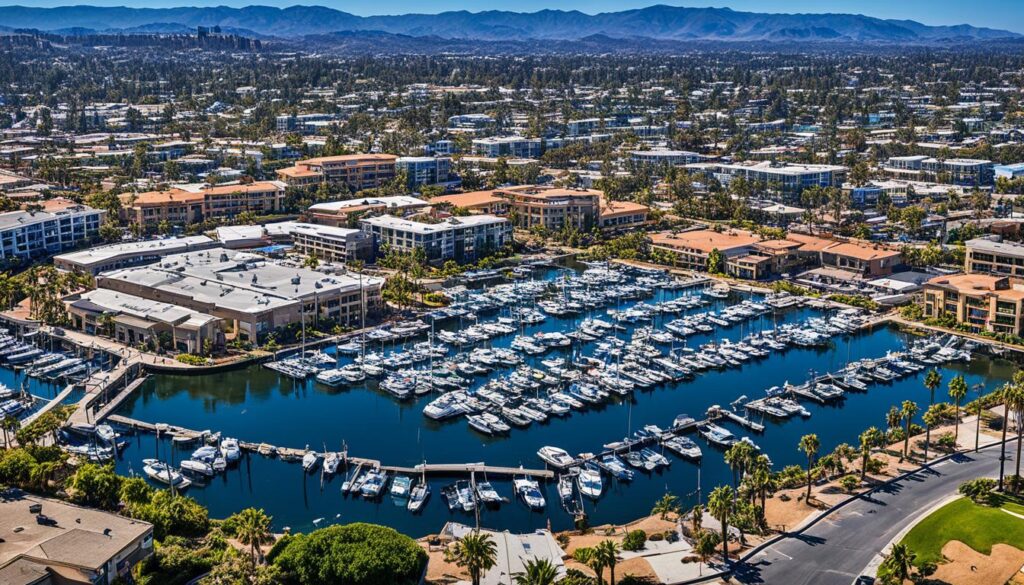

Commercial real estate loans are a vital tool for businesses looking to invest in properties in North County, California. Whether you need financing for office buildings, retail malls, shopping centers, or hotels, The Zion Group – San Diego offers expert financing solutions tailored to meet your specific needs in North County.

Key Takeaways:

- Commercial real estate loans are essential for businesses looking to invest in properties in North County, California.

- The Zion Group – San Diego offers tailored financing solutions for commercial real estate projects in North County.

- Commercial loans differ from residential loans in terms of borrower qualifications and repayment terms.

- Lenders for commercial loans can include banks, independent lenders, insurance companies, pension funds, and private investors.

- Borrowers need to carefully consider their financial track record, credit rating, and loan terms before committing to a commercial real estate loan.

Understanding Commercial Real Estate Loans

Commercial real estate loans play a crucial role in financing the acquisition, development, and construction of income-producing properties. Unlike residential loans, commercial loans are typically made to business entities such as corporations, developers, limited partnerships, and trusts. Let’s delve deeper into the characteristics of commercial real estate loans and the lenders involved in this sector.

- Commercial loans have shorter terms compared to residential loans, typically ranging from five years to 20 years.

- Amortization periods for commercial loans are often longer than the loan term. This allows borrowers to spread out their payments over a more extended period, effectively managing their cash flow.

- Lenders for commercial loans may require a higher down payment from borrowers compared to residential loans. It’s not uncommon for commercial lenders to have loan-to-value ratios in the range of 65% to 80%.

- Various financial institutions and investors serve as sources of capital for commercial real estate loans, including banks, independent lenders, insurance companies, pension funds, and private investors.

As you can see, commercial real estate loans have their unique characteristics and are tailored to meet the financing needs of businesses and developers. Whether you’re looking to acquire office buildings, retail malls, shopping centers, or hotels, understanding the intricacies of commercial loan financing will help you make informed decisions for your investment.

Loan Comparison: Residential vs. Commercial

| Loan Characteristics | Residential Loans | Commercial Loans |

|---|---|---|

| Eligible Borrowers | Individuals, families | Business entities, developers, partnerships, trusts |

| Loan Terms | Longer terms, often 30 years | Shorter terms, typically 5 to 20 years |

| Amortization Period | Matches the loan term | Can be longer than the loan term |

| Down Payment | Generally lower down payment requirements | Higher down payment requirements |

| Loan-to-Value Ratio | In the range of 80% to 97% | In the range of 65% to 80% |

Now that we’ve explored the characteristics of commercial real estate loans, it’s essential to understand the considerations borrowers should keep in mind and how loan repayment works. We’ll delve deeper into these topics in the next section.

Borrower Considerations and Loan Repayment

When applying for a commercial real estate loan, several important considerations come into play. As a borrower, you need to carefully assess your financial track record and credit rating to determine your eligibility and potential interest rates. Lenders may also require personal guarantees or collateral, depending on the circumstances surrounding the loan.

Commercial loans typically have shorter repayment terms compared to residential loans, ranging from five to 20 years. However, the amortization period for commercial loans is often longer than the loan term, allowing borrowers to repay principal and interest over an extended period of time.

It’s important to note that interest rates on commercial loans are generally higher compared to residential loans. The increased risk associated with commercial properties, coupled with the unique financing needs of businesses, contributes to higher interest rates. Additionally, borrowers should be aware that commercial loans may be subject to various fees, including appraisal, legal, and loan origination fees.

Furthermore, borrowers should be mindful of prepayment penalties, which may apply if they decide to pay off the loan early. These penalties are designed to compensate lenders for the loss of anticipated interest revenue when loans are paid off sooner than expected.

It is crucial for borrowers to thoroughly review the terms and conditions of the loan, seeking clarification on any uncertainties or concerns. By taking the time to consider these important factors, borrowers can make informed decisions and ensure a successful loan repayment journey.

“Borrowers should carefully evaluate their financial standing and loan terms to effectively manage loan repayment.”

Borrower Considerations and Loan Repayment Checklist

- Evaluate your financial track record and credit rating.

- Consider the potential need for personal guarantees or collateral.

- Understand the repayment terms, including the loan term and amortization period.

- Be aware of the higher interest rates associated with commercial loans.

- Take into account additional fees, such as appraisal, legal, and loan origination fees.

- Review prepayment penalty terms and potential costs.

- Thoroughly examine the loan agreement and seek clarification on any uncertainties.

By keeping these considerations in mind, borrowers can navigate the loan repayment process more effectively and make sound financial decisions.

Comparison of Interest Rates and Fees

| Loan Type | Interest Rates | Fees |

|---|---|---|

| Residential Loans | Low | Appraisal fees |

| Commercial Loans | Higher | Appraisal fees, legal fees, loan origination fees |

Conclusion

When it comes to investing in properties in North County, California, commercial real estate loans are a crucial resource for businesses. The Zion Group – San Diego offers personalized financing solutions that cater to the specific needs of businesses in the area. With their expertise in commercial real estate loans and their extensive service area in San Diego County, they have established themselves as a trusted partner for businesses seeking to maximize the potential of their properties.

By utilizing the tailored financing solutions provided by The Zion Group, businesses in North County can fuel their growth and achieve their goals. Whether you are looking to invest in office buildings, retail malls, shopping centers, or hotels, their experienced team can guide you through the lending process and help you secure the funding needed for your commercial real estate projects. With their assistance, you can take advantage of the opportunities available in North County and make informed decisions that will benefit your business for years to come.

Unlock the potential of your business properties in North County with the help of The Zion Group. Their commitment to providing comprehensive financing solutions for commercial real estate projects sets them apart from other lenders. Don’t miss out on the chance to accelerate your business growth. Contact The Zion Group – San Diego today and explore the financing options available to you.

FAQ

What are commercial real estate loans?

Commercial real estate loans are financial products that businesses can use to invest in properties. These loans are specifically designed for property acquisitions, developments, and construction of income-generating properties.

How do commercial real estate loans differ from residential loans?

Commercial loans are made to business entities such as corporations, developers, limited partnerships, and trusts. They have shorter terms, ranging from five to 20 years, and lenders may require a higher down payment and have loan-to-value ratios of 65% to 80%.

Who are the sources of capital for commercial real estate loans?

Banks, independent lenders, insurance companies, pension funds, and private investors are all sources of capital for commercial real estate loans. These lenders provide the necessary funds to finance commercial real estate projects.

What factors do borrowers need to consider when applying for a commercial real estate loan?

Borrowers need to consider their financial track record, credit rating, and may be required to provide personal guarantees or collateral. They should also carefully review the terms and conditions of the loan, including repayment terms, interest rates, and fees before making any commitments.

What are the repayment terms and interest rates for commercial real estate loans?

Commercial loans typically have shorter repayment terms than residential loans, ranging from five to 20 years, with longer amortization periods. Interest rates on commercial loans are generally higher than residential loans due to the higher risk associated with commercial properties.

Are there any additional fees associated with commercial real estate loans?

Yes, borrowers may incur additional fees such as appraisal, legal, and loan origination fees when obtaining a commercial real estate loan. These fees can vary depending on the lender and specific loan terms.

Can borrowers pay off a commercial real estate loan early?

Yes, borrowers can pay off a commercial real estate loan early. However, prepayment penalties may apply, depending on the terms of the loan agreement. It is important for borrowers to review the specific terms and conditions before making any decisions.

Recent Comments